-

-

-

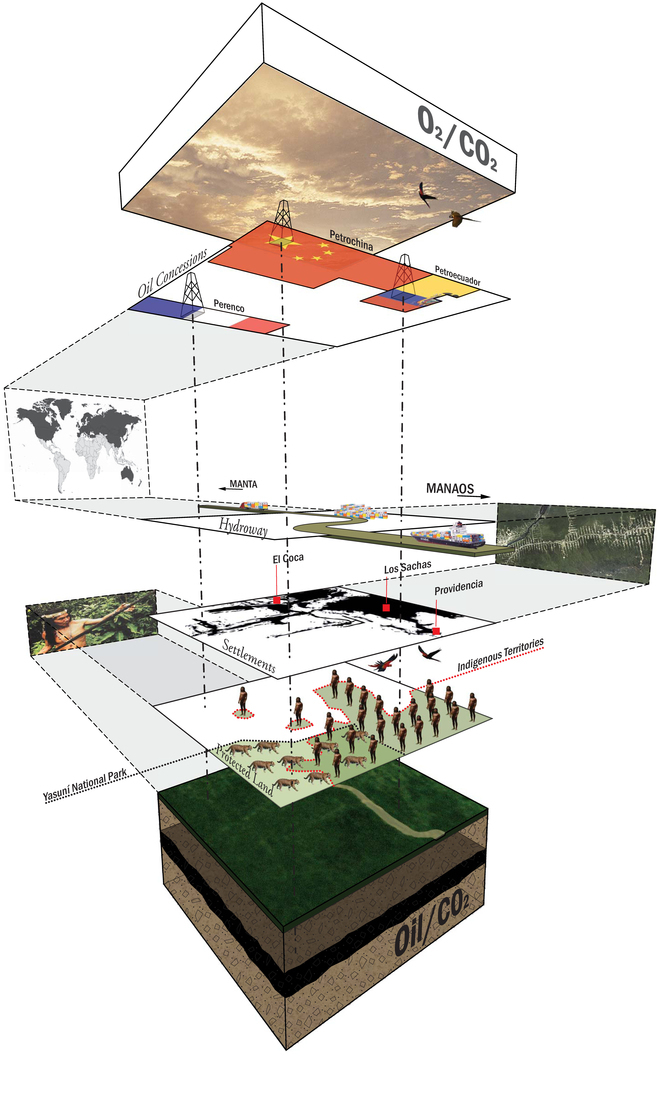

Infrastructure space/

Santiago del Hierro:

Yasuní-ITT

-

Yasuní and the Carbon Market. Why Not.

The Yasuní-ITT Initiative was proposed in 2007 following a series of protests by environmental activists against the Ecuadorian government’s plan to extract oil in the ITT1 block under the Yasuní National Park. It was developed at first by the Ministry of Energy and Non-Renewable Resources and opened up an opportunity for indigenous communities and NGOs to propose economic alternatives to oil extraction in the Yasuní. The position of the government was clear: conservation of the forest’s biodiversity and respect for indigenous communities in voluntary isolation are a priority for the State –Ecuador is the first country in the world to have nature’s rights on its constitution–, but it would be too much to forego income from the exploitation of the ITT block which holds 20% of the country’s oil reserves. Conservation for conservation’s sake was not a sustainable option. Income from oil would need a substitute.

As of May 2009, 850 million barrels of oil were valued at US$ 7 billion2. This amount of oil, when consumed, would release 407 million metric tons of CO2 to the atmosphere, an amount of carbon dioxide that would have a value of US$ 7.2 billion at the European Union Emissions Trading Scheme (EU ETS), the world’s largest greenhouse gas emissions trading system. The surprising closeness of both values led to the idea that keeping oil underground, if considered non-emitted CO2, could be as profitable as extracting it.

Roque Sevilla, president of the Yasuní-ITT Commission and an economist and environmentalist with strong ties to the tourism industry in Ecuador, started a campaign to enter the carbon market with CGYs (Yasuní Guarantee Certificates) as equivalent units to carbon credits. It would be the first time that biodiversity could be considered a commodity to compete with the extraction of a resource like oil, and also an opportunity for low carbon emission countries to actively enter the carbon market, a trading game that, since the establishment of the Kyoto Protocol in 1997, was meant only for big-time polluting countries. What the non-emission of CO2 that the Yasuní-ITT Initiative would contribute to the world was comparable to what Brazil or France emit in a year or what Ecuador emits in 13 years.

A few months after Sevilla and his team had promoted the Yasuní idea to several European Governments, it was categorically denied by the EU ETS. The Initiative would brake one of the main rules that had been established by the Clean Development Mechanism of the Kyoto Protocol. This rule is known as carbon leakage, which occurs when there is an increase in carbon dioxide emissions in one country as a result of an emissions reduction by a second country. Applying this concept to the Yasuní-ITT meant that keeping 850 million barrels of oil underground would not reduce emissions, as this oil would be replaced at once by oil extracted from another country. The way any market works. Carbon leakage made the conversion of CGYs to carbon credits impossible and the Yasuní-ITT Commission had to withdraw their proposal to enter the EU Emissions Trading Scheme and the project turned into the pursuit of bilateral agreements between governments in which Ecuador would have to rely on other countries’ condescending sympathy with the value of biodiversity in the Yasuní National Park and the risk posed by oil extraction in this region.

-

Why Yes.

At the L’Aquila G8 summit in July 2009, the Major Economies Forum recognized the scientific view that the increase in global average temperature ought not to exceed 2°C above pre-industrial levels. Science shows that this means a reduction of global greenhouse gas emissions3 in at least 50% compared to 1990 levels by 20504. It is expected that a binding agreement with these objectives in emission reductions will be achieved at the Conference of Parties (COP) 17 in Durban, South Africa on November 2011. If such an agreement is reached, a progressive cut in the demand of oil has to occur over the next 40 years. Alternative energy technologies would soon have to provide financially feasible solutions and the whole energy matrix of the world would be forced to reduce its dependence on oil and its derivatives.

On the other side of the coin, reducing the demand of oil during this period of time would also require a decrease in the supply of this resource. If the world needs to go from consuming 27,700 million barrels of oil in 20095 to 14,700 million barrels of oil by 2050, then 325 million barrels of oil have to be kept underground per year in a progressive manner until 2050. In a business-as-usual scenario, this oil would probably remain untapped in countries that can afford to wait for cheaper extraction technologies and for oil prices to climb (which definitely will as this resource becomes scarcer). Governments of developing nations, on the other hand, can’t afford to strategize in the same way and are forced to extract as much of their natural resources as possible. It coincides that many of the mega-biodiverse tropical rainforests of the world belong to these countries. And under some of them, there is oil6.

Home to more biodiversity than all other biomes together, tropical rainforests are more vulnerable to negative direct and indirect effects of oil extraction than ecosystems like cold and subtropical deserts, where many Middle Eastern and American oil reserves are found. Rainforests are also achieving a high rank among ecosystems to which the international community aims resources7. Therefore, a global trading system already in place like the carbon market could be re-thought as a platform to value the non-emission of carbon dioxide by avoiding extraction processes in highly vulnerable ecosystems. As a certain amount of oil will have to stay underground in the long term, then carbon leakage stops making sense as it will not only be up to the market to define supply, but to international restrictions as well. A coalition of rainforests that meet the conditions set by the Yasuní-ITT Initiative could then be allowed to sell their avoided emissions in exchange of proved conservation of biodiversity. Projects like these would be able to “buy” the extra time forests need until world-wide binding conservation schemes are strong enough to compete with resource extraction8. The carbon market could then undertake a double mission by encouraging certain regions of the world to avoid oil extraction (part of the 325 million barrels that need to be reduced annually), mitigating climate change and reducing pressure on the biodiversity of these fragile ecologies.

-

To comply with global warming objectives by 2050, the world should progressively reduce the emission of 5,620 millions metric tons of CO2 per year.

-

1 barrel of oil generates 0.433 metric tons of CO2. The world should consume 325 million barrels of oil less per year.

-

The world should only access 64.8% of its proved oil reserves. 35.2% have to remain underground until 2050. Where?

-

1 ITT stands for Ishpingo-Tambococha-Tiputini, the places where the oil block is located

2 West Texas Intermediate crude oil pricing

3 Greenhouse gases are composed of six chemical compounds. Carbon dioxide is one of them and corresponds to approximately 60% of the GHGs produced by human activity. In this analysis we are only taking into account the reduction of Carbon Dioxide emissions from the consumption of petroleum, assuming its proportionate value to the rest of GHGs

4 See “Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions”. Stepping up international climate finance: A European blueprint for the Copenhagen deal. Commission of the European Communities, Brussels, 2009

5 CIA World Factbooks, 18 December 2003 to 28 March 2011

6 It is estimated that around than 1.6% of the world’s proved oil reserves are under rainforests located in mega diverse, developing tropical countries. Sites where the Yasuní-ITT Initiative promotes replicability.

7 For ecosystem valuation see www.ecosystemvaluation.org and www.fsd.nl/naturevaluation

8 REDD+, a UN sponsored program has already developed mechanisms that work with carbon markets to provide funds for forest conservation (based on forests’ function as carbon sinks). However, the financial compensations offered by REDD+ are minimal in comparison to income from extracting a resource like oil -

Planes of Violence

-

-

-

-

-

©2012 The authors and contributors

-